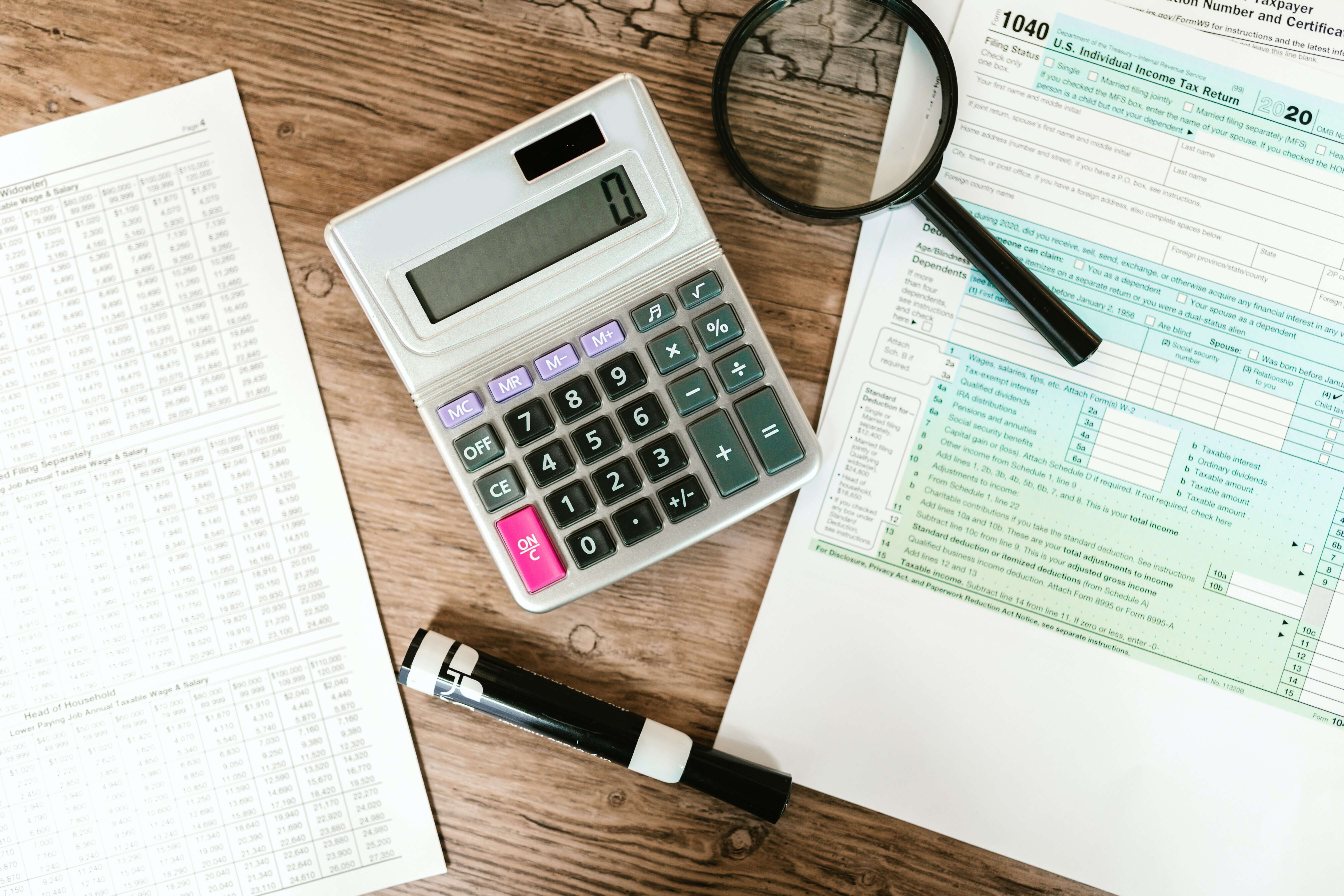

Your Financial Success Starts Here

At H&H Tax Consultants, we pride ourselves on offering personalized solutions tailored to your unique needs. Whether you're seeking expert tax advice, comprehensive accounting services, or strategic financial planning, we're here to guide you every step of the way. Our commitment to transparency, excellence, and client-centered service sets us apart as your trusted financial partner.

Our Services That Helps you Ethically Save More on Taxes...

Tax Preparation and Planning for Individuals:

Maximize Your Refund: Our expert team will ensure you claim every eligible deduction and credit, optimizing your tax refund.

Minimize Tax Liability: We'll help you implement effective tax strategies to reduce your tax burden while staying compliant with Australian tax laws.

Year-Round Support: Beyond tax season, we offer year-round assistance and advice to help you make informed financial decisions

Tax Preparation and Planning for Businesses

Strategic Tax Solutions: Our business-focused tax services are designed to minimize your tax liability and enhance your financial stability.

Business Structure Optimization: We'll analyze your business structure to ensure it's tax-efficient, helping you make the most of available tax benefits.

Comprehensive Compliance: Stay on top of your tax obligations with our thorough compliance services, avoiding penalties and audits.

Bookkeeping Services

Accurate Financial Records: Our meticulous bookkeeping ensures your financial records are precise, providing a solid foundation for informed decision-making.

Time and Cost Savings: Outsourcing your bookkeeping to us frees up your valuable time to focus on growing your business.

Financial Insights: Gain insights into your business's financial health with regular reports and analysis.

Financial Reporting

Clarity and Transparency: Our financial reporting services provide clear, easy-to-understand reports that offer valuable insights into your financial performance.

Informed Decision-Making: Use our reports to make informed business decisions, track progress, and identify opportunities for improvement.

Compliance Assurance: We ensure your financial reports comply with Australian accounting standards and regulations.

Audit & Assurance Services

Risk Mitigation: Our comprehensive audits help identify potential risks and areas for improvement, enhancing your business's financial stability.

Data Accuracy: We verify the accuracy and integrity of your financial data, ensuring it's reliable for decision-making.

Compliance Confidence: Our audits ensure your compliance with industry regulations and boost investor and stakeholder confidence.

Financials Consulting Services

Strategic Financial Planning: Collaborate with us to develop tailored financial strategies that align with your goals and aspirations.

Performance Enhancement: Leverage our expertise to improve your business's financial performance and maximize profitability.

Long-Term Success: Our financial consulting services are designed to set you on a path toward sustained financial success.

Business Advisory

Business Growth: Our advisory services provide guidance on expanding your business, entering new markets, and seizing growth opportunities.

Financial Health Check: We conduct in-depth financial assessments to identify areas for improvement and develop actionable plans.

Succession Planning: Ensure a smooth transition of your business to the next generation with our succession planning expertise.

Payroll & Compliance

Efficient Payroll Processing: Streamline your payroll processes, ensuring timely and accurate payments to employees.

Compliance Assurance: We'll help you navigate complex payroll tax regulations and employment compliance, reducing the risk of penalties.

Employee Benefits Management: Ensure your employees are well taken care of with our employee benefits management services.

Loan Assisstance

Our loan assistance services are designed to simplify the borrowing process and help you make informed decisions. Whether you're seeking a personal loan, mortgage, or business financing, we provide expert guidance and support every step of the way. Trust us to find the loan solutions that best suit your needs and financial goals. Let's make your dreams a reality.

GST - BAS

We prepare and lodge Business Activity Statements (BAS) to ATO on monthly, quarterly and annual basis for multiple types of industries such as Property Developers, Builders, Form-Worker, IT, Security, Car Dealers, Hoter, Motel, Restaurants, Gas Stations, Wholesale and Retail Trading, Family Day Care, Uber, Taxi and all other industries.

Self Managed Super Funds (SMSF)

We offer full range of Self Managed Super Funds (SMSF) services. SMSF are operated and run by members for their own benefits, unlike the public regulated superannuation fund who manage your super contributions .

Establishments of a new Self Managed Super Fund (SMSF) and registration for an Australian Business Number (ABN), Tax File Number (TFN) and Goods and Services Tax (GST).

Setting up a company to act as a corporate trustee(where applicable)- Preparation of Annual Financial statements, Tax and regulatory returns, Annual member statements and organise the apppointment and completion of an independent audit for each SMSF as required by the ATO.

What Our Clients Say About Us

"Switching to H&H Tax Consultants was one of the best decisions I made for my business. Their expertise in tax planning has not only reduced my tax burden but also allowed me to reinvest in my company's growth."

"I can't thank H&H Tax Consultants enough for their exceptional tax services. Their attention to detail and expertise saved me both time and money. I highly recommend them to anyone in need of top-notch accounting professionals."

Ready To Save Your Income From Getting Drained & Multiply It Incredibly?

"Excellence in Accounting, Backed by Credentials."

About H&H Tax Consultants

When you choose H&H Tax Consultants, you're choosing a team that is deeply invested in your financial well-being.

With us, you'll find not just financial experts but also trusted advisors who are here to support you on your journey to financial success.

CONTACT

Phone Number

- 0491 074 050

- 02 4939 1880

Email Address

- info@hhtax.com.au

Office Location

- 299 Marion St. Yagoona NSW - 2199